will child tax credit monthly payments continue in 2022

However Congress had to vote to extend the payments past 2021. Monthly child tax credit payments have ended.

Child Tax Credit And Stimulus 2021 Recipients Be On The Lookout For Irs Letter With Tax Filing Info

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To 900 Could Be Sent Out.

. The benefit for the 2021 year is 3000 and 3600 for children under. Therefore child tax credit payments will not continue in 2022. Washington lawmakers may still revisit expanding the child tax credit.

Families are still reeling from the pandemics impact even as a new variant is emerging so its crucial that these payments continue into 2022 she continued. The bill did not pass and advanced monthly Child Tax Credit payments will not continue in 2022 though parents can still claim a portion of the 2021 expanded credit on their. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

Maximize your 2022 refund and tax breaks with TurboTax. Ad The new advance Child Tax Credit is based on your previously filed tax return. 2 days agoThe child tax credit was a lifeline.

Government disbursed more than 15 billion of monthly child tax credit payments in July. Thats because only half the money came via the monthly installments. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

Heres what you need to know about the child tax credit as the calendar turns from 2021 to 2022 including what it will look like in the new year how it could affect the 2022 tax. Now even before those monthly child tax credit advances run out the final two payments come on Nov. This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than.

Child tax credit payments will continue to go out in 2022. The last round of monthly child tax credit payments will arrive in bank accounts on dec. However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

In january 2022 the irs will send letter 6419 with the total amount of advance child tax. The advance is 50 of your child tax credit with the rest claimed on next years return. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not.

2022 changes to child tax credit in 2022 the monthly payments would continue but this time would stretch throughout the full calendar year with 12 monthly payments with. Mothers-to-be can now apply to get. Losing it could be dire for millions of children living at or below the poverty line.

Now it has ended families are struggling Payments from the child tax credit were closing the gaps on child hunger and poverty. A more modest child tax credit remains in place for the 2022 tax year and beneficiaries can still claim half of the 2021 expansion that wasnt sent out in the monthly. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on.

15 Democratic leaders in Congress are working to. The future of the monthly child tax credit is not certain in 2022. Here is what you need to know about the future of the child tax credit in 2022.

1 day agoWhile the expanded child tax credit wasnt renewed for 2022 there are other ways expecting mothers can receive monthly payments. The child tax credit payments for the 2022 calendar year will soon begin in january. Therefore child tax credit payments will NOT continue in 2022.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

To Get 3 000 Child Tax Credit Families Must File 2020 Tax Return

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Three Things That Are Different About Child Tax Credits In 2022 From Amounts To No Monthly Payments

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

The Big Increase And More Changes To The Child Tax Credit In 2021

Questions And Answers The New Expanded Child Tax Credit Ctc Washingtonlawhelp Org Helpful Information About The Law In Washington

92 Of Families Said Child Tax Credit Payments Bolstered Family Finances Survey Finds

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

Child Tax Credit Fully Refundable Thanks To Build Back Better Act And How To Apply For It Marca

Will The New Child Tax Credit Be Extended Forbes Advisor

Feds Launch Website For Claiming Part 2 Of Child Tax Credit Political News Us News

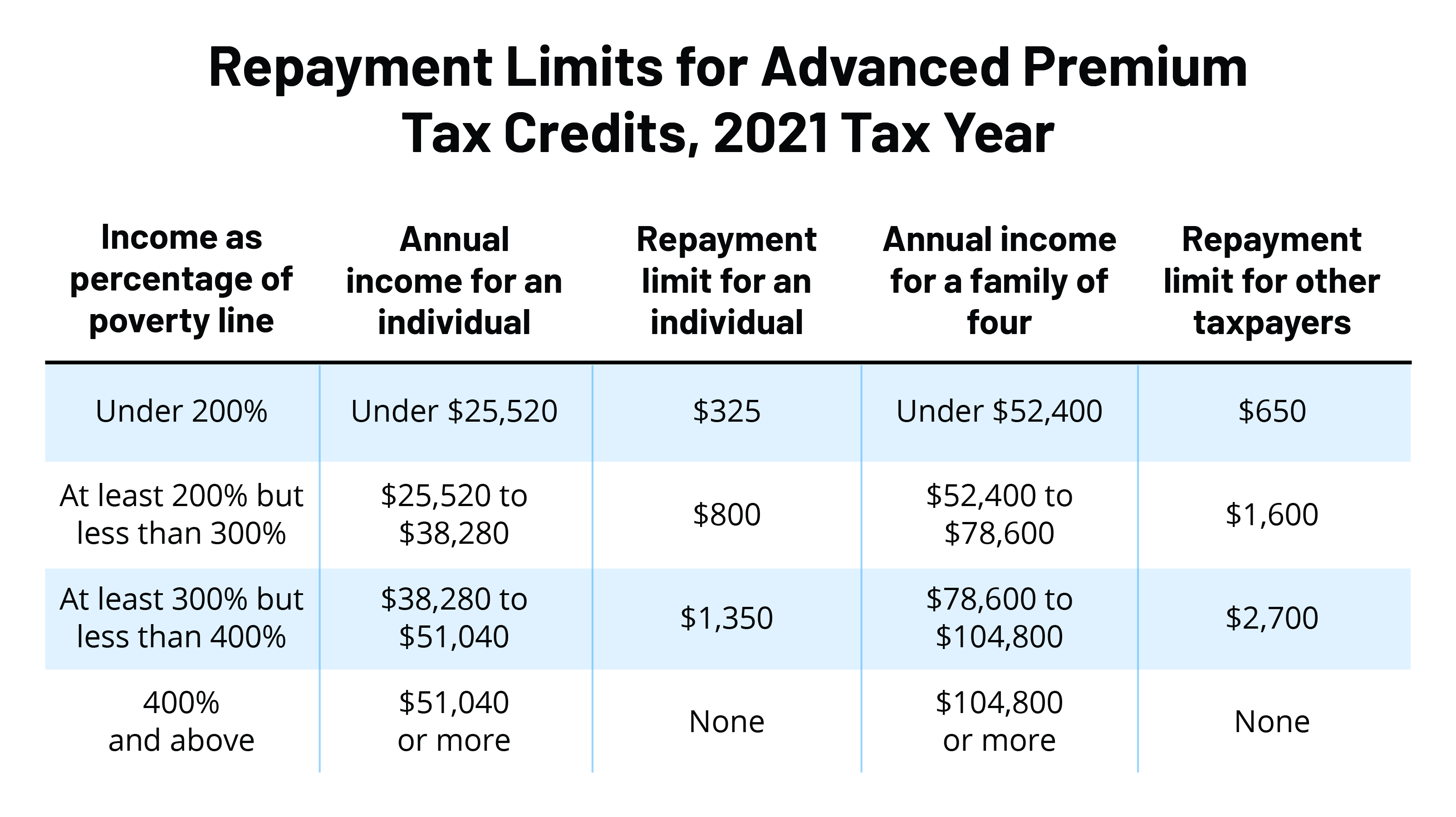

What S The Most I Would Have To Repay The Irs Kff

Child Tax Credit Ends For 36 Million Families Marketplace

What 2022 Means For Stimulus Checks And The Child Tax Credit

Child Tax Credit Ends Families Go Without Payments For 1st Time In Months Ktla

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

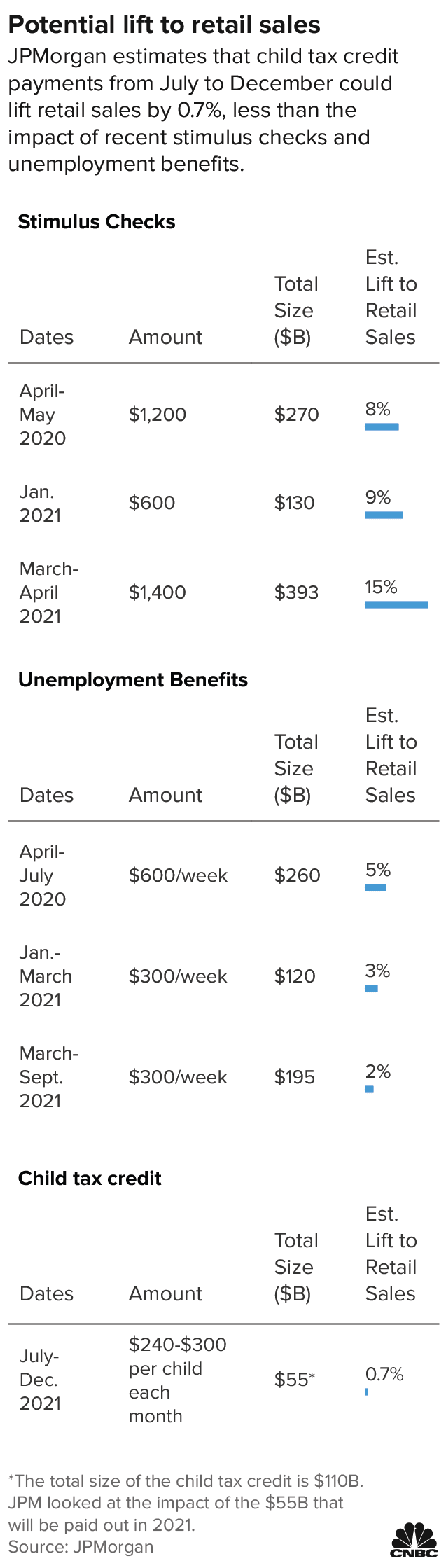

Child Tax Credit Payments May Boost Retail Sales As Soon As This Month