is preschool tax deductible 2020

To the millions of you who have been with us. You can make your gift at any.

Is Preschool Tuition Tax Deductible Motherly

Thời hạn báo trước khi đơn phương chấm dứt HĐLĐ với nghề đặc thù Chính phủ vừa ban hành Nghị định 1452020NĐ-CP quy định chi tiết và hướng dẫn thi hành một số điều của Bộ luật lao động về điều kiện lao động và quan hệ lao động.

. Theo đó khi NLĐ làm ngành nghề công việc đặc thù đơn phương. This lets us find the most appropriate writer for any type of assignment. Building a Model School Campaign.

Arts Council for the allocation of grants to individuals or organizations administering arts programs for children in preschool through 12th grade. If youre the parent of a child with special needs there are some tax strategies to be aware of that can save your family money. Our Preschool is an accredited independent 5-Star tuition-based early learning center serving children ages 24 months to 4-years-old 4-years old who are not yet age eligible for 4K.

Being self-employed means that you are not going to have state and federal taxes withheld from a paycheck this guarantees that you will owe the IRS money for self-employment tax. ASCII characters only characters found on a standard US keyboard. Our goal is to provide quality education with a Biblical worldview.

To reduce this amount you need to be saving receipts and making sure you are on top of all the possible tax write-offs that will make tax time less painful and costly. Allows the claim and the allowed amount went toward the members deductible include the insurance explanation of benefits EOB when billing Montana Healthcare Programs. Although state-funded we rely on the generosity of our families and the community to help our school grow and to continue to provide a well rounded education for our students.

Because deposits are not federally tax-deductible you can put as much away as you please or can afford. If approved we will issue a determination letter that describes your tax-exempt status and your qualification to receive tax. Grand View Christian Academy is a private Christian school located in Beavercreek OR.

These papers are also written according to your lecturers instructions and thus minimizing any chances of plagiarism. Payment you sent with form FTB 3519 Payment for Automatic Extension for Individuals. Denies the claim submit the claim and a copy of the denial including the reason explanation to Montana Healthcare Programs.

6 to 30 characters long. Look into a 529 saving plan which lets you deposit money that can grow tax-free. Use Form 1023 including the appropriate user fee to apply for recognition of exemption from federal income tax under section 501c3.

All gifts to Penn-Mont are 100 tax deductible. Expenses at an adult day care facility but not expenses for overnight nursing home facilities. The cost of day care and housekeeping services in your home for your child or other qualifying individual.

By making a tax-deductible donation or by volunteering your time youll help ensure that our incredible programs and activities continue. Line 14 Attorney accountant and tax return preparer fees. You may not figure a credit for mobile home privilege tax penalties or fees included in your property tax bill or the portion of the property tax that is deductible as a business expense.

The comptroller shall keep a distinct account of actual receipts of non-tax revenues by each department board commission or institution to furnish the executive office for administration and finance and the house and senate committees on ways and means with quarterly statements comparing those receipts with projected receipts set forth in this section. We are moving in a new direction focusing our efforts more fully on making transformational change within organizations to create equity and inclusion in the workplace for all. Please join us by making a tax-deductible financial contribution to our We Are One 2022.

Get 247 customer support help when you place a homework help service order with us. Must contain at least 4 different symbols. Penn-Mont Academy is a private non-profit non-sectarian Montessori school offering infant toddler preschool and elementary programs for children ages 6 weeks 12 years.

502 261-9687 email protected. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Enter deductible attorney accountant and tax return preparer fees paid for the estate or the trust.

What is a health savings account HSA. States with income taxes allow but limit 529 credits. DCFSAs can be used to help cover the cost of daycare preschool and elder care.

Same-year tax benefits apply only at the state level. The Academy for Individual Excellence 3101 Bluebird Lane Louisville KY 40299 Phone. Overpayment from your 2020 California income tax return that you applied to your 2021 estimated tax.

The contributions to an HSA are tax-deductible. 2020 Tax Rate Schedule. Apple Valley Christian Academy does not discriminate on the basis of race color sex or national or ethnic origin in administration of its educational policies admissions policies scholarship program and athletic and other school-administered programsApple Valley Christian Academy does reserve the right to select students on the.

For the time you owned and lived at the property during 2020 if that residence was in Illinois. For example you can deduct the cost of many out-of-pocket expenses on your federal taxes. 10201 The act imposes a non-deductible 1 excise tax on the fair market value of stock repurchased by a publicly traded domestic corporation after 2022 with certain exceptions including for repurchases that are part of a reorganization are less than 1 million that are contributed to certain tax-exempt retirement plans or that are.

All our clients are privileged to have all their academic papers written from scratch. After over 40 years of serving working parents the Working Mother chapter is coming to a close. Expenses for an unlicensed day care center that cares for six or fewer children.

Nonresidents of Illinois may not take this credit. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Expenses for a day care center summer day camp or preschool.

California estimated tax payments made on your behalf by an estate trust or S corporation on Schedule K-1 541 or Schedule K-1 100S. Special schooling evaluations medical travel supplies and equipment special diets legal expenses and more. All our academic papers are written from scratch.

Putting your youngsters into private K-12 schools.

12 Expenses That Aren T Tax Deductions For Most Taxpayers

Are Contributions To School District Programs Tax Deductible Turbotax Tax Tips Videos

Preschool Bethesda Christian Schools

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

Happenings In Education March 2020

Transitional Kindergarten In California Without State Help Calmatters

Your 2021 Child Care Costs Could Mean 8 000 Tax Credit

The Time Space Percentage Taking Care Of Business

Dumbo Imagine Early Learning Centers

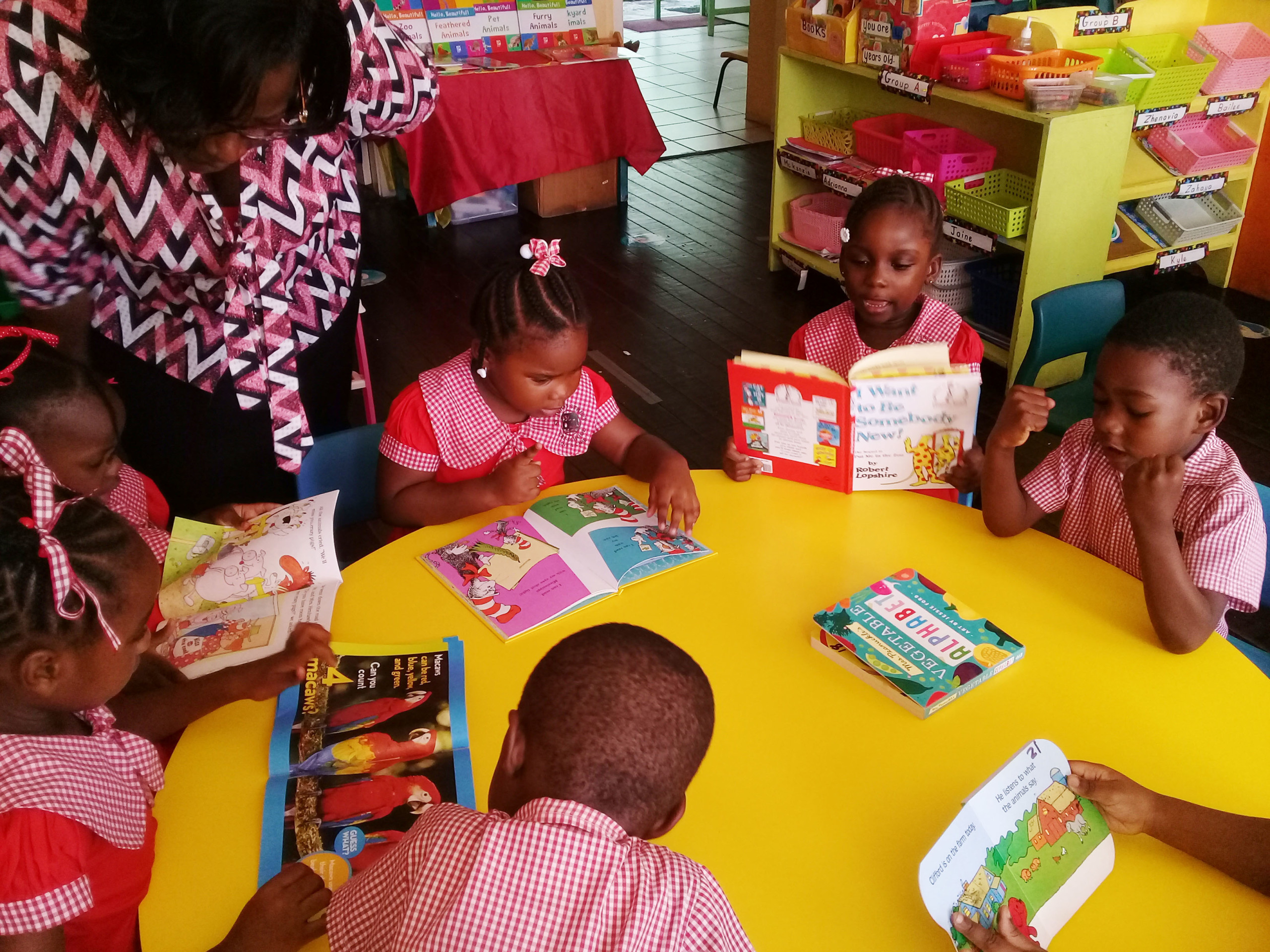

Preschool Program Hands Across The Sea

The 5 Best Tax Breaks For Parents Forbes Advisor

Tuition Support Preschool Daycare Serving Santa Monica Ca

Is Preschool Tuition At A Church Tax Deductible

Can A Pre K Teacher Take The Teachers Deduction On The 1040

Publications Children S Institute Supporting Oregonians Kids

Food Allergies In Early Childhood Foodallergy Org

Are Child Care Expenses Tax Deductible Merrimack Tax Associates